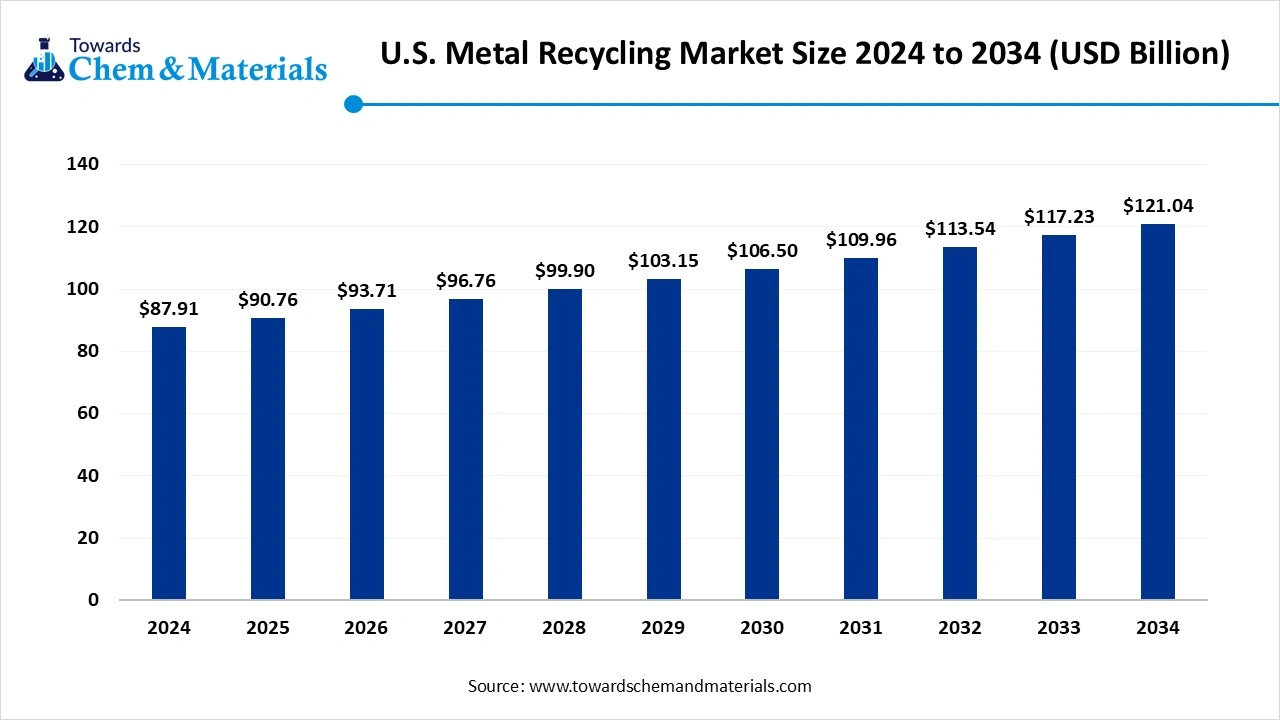

U.S. Metal Recycling Market Size to Cross USD 121.04 Bn by 2034

According to Towards Chemical and Materials, the U.S. metal recycling market size is calculated at USD 90.76 billion in 2025 and is expected to be worth around USD 121.04 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.25% over the forecast period 2025 to 2034.

Ottawa, Oct. 13, 2025 (GLOBE NEWSWIRE) -- The U.S. metal recycling market size was valued at USD 87.91 billion in 2024 and is anticipated to reach around USD 121.04 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.25% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The Rising demand for sustainable raw materials and circular economy initiatives is driving growth in the market.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5873

U.S. Metal Recycling Overview

The U.S. metal recycling market is experiencing strong momentum driven by growing environmental awareness, increasing demand for sustainable raw materials, and government initiatives promoting circular economy practices. The industry plays a critical role in reducing waste, conserving energy, and lowering carbon emissions by transforming discarded metals into reusable resources for various sectors. Ferrous metals dominate the market due to their widespread use in construction, automotive, and heavy machinery applications, while non-ferrous metals such as aluminium, copper, and zinc are gaining traction for their high economic value and recyclability. Mechanical recycling remains the most common method due to its cost efficiency and recyclability. Mechanical recycling remains the most common method due to its cost efficiency and scalability, while hydrometallurgical processes are emerging as advanced alternatives for complex materials.

U.S. Metal Recycling Market Report Highlights

- By metal type, the ferrous metals segment led the U.S. metal recycling market with approximately 60% industry share in 2024, due to its widespread use in the major sectors like automotive, manufacturing, and construction.

- By recycling method, the mechanical process segment emerged as the top-performing segment in the market with approximately 50% industry share in 2024, as it is considered the cost-effective, scalable, and simple yet ideal option

- By source, the post-industrial scrap segment led the market with approximately 40% share in 2024, because it provides cleaner, higher-quality materials directly from manufacturing waste.

- By end user industry, the automotive segment led the market with approximately 30% industry share in 2024, because end-of-life vehicles are one of the largest sources of scrap metals in the U.S.

- By recycling facility type, the integrated mills segment led the U.S. metal recycling market with approximately 45% share in 2024, as the U.S. faces rising e-waste volumes from rapid tech consumption.

Benefits of in Metal Recycling Market

Metals, including Critical Raw Materials, are an ideal candidate for a circular economy as they are eternally recyclable, and properly treated, secondary metals do not face downcycling or quality issues. Since they do not lose their intrinsic properties during recycling, metals can be used and re-used multiple times, maintaining their quality and functionality

1.Socio-economic benefits;

• The EU produces only about 3% of the primary raw materials required to sustain a growing demand for metals. Consequently, the EU’s metal recycling value chain contributes to reduce EU’s dependency on imported materials.

• The Recycling of metals is labor intensive and creates a wide variety of job opportunities for skilled workers who carry out a range of functions relating to the collection and sorting of EoL products containing metals.

2.International trade

• The Metal waste collected and reprocessed into scrap, compliant with industry specifications, and standards, compete on commodity markets with primary materials. Recyclers are not competing on a level playing field since the market fails to reward the environmental benefits in terms of resource, energy, and CO2 savings resulting from the use of secondary materials.

• The Removing the barriers affecting the internal market for recycling, resulting from complex waste shipment procedures, as well as ensuring free and fair trade of secondary raw materials, is crucial to balance supply and demand and guarantee the proper functioning of recycling markets.

3.Environmental benefits

• The metal recycling industry is a major contributor to both, the circular economy and climate policy, by saving primary resources, energy, and CO2. However, European policy framework has so far failed to reward the environmental benefits of metal recycling which could further boost its circularity.

• The Metals recycling will reduce landfill of metals, which is not only a loss of valuable raw materials, but could also generate an impact on the environment (i.e., leaching into water courses).

• The Metals recycling saves up to 20 times (i.e., between 60-95%) of the energy needed compared to the extraction of those metals from ores whilst preserving the quality. That directly impacts the costs of re-processing those metals into final products.

• The Production of metals from secondary raw materials significantly reduces CO2 emissions compared to their primary production (i.e., mining), and also reduces the derived impact on the water and the land. Using recycled metal instead of finite virgin ores reduces air pollution by 80%, water pollution by 76%, and water use by 40%

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/checkout/5873

U.S. Metal Recycling Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 99.76 billion |

| Revenue forecast in 2034 | USD 121.04 billion |

| Growth rate | CAGR of 3.25% from 2024 to 2034 |

| Actual data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD billion, volume in million tons, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Metal Type, By Recycling Method, By Source, By End-User Industry , By Recycling Facility Type |

| Key companies profiled | CMC; European Metal Recycling; Novelis; Norsk Hydro ASA; Tata Steel; GFG Alliance; Kimmel Scrap Iron & Metal Co., Inc; Schnitzer Steel Industries, Inc., Sims Metal, Utah Metal Works |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Why Is It Important to Recycle Metals?

1. To preserve natural resources. Recycling metal replaces the need to produce virgin metal. In turn, this preserves precious natural resources like coal and iron ore used in metal production. It’s essential to consider resources like coal, as its combustion is a top contributor to climate change. In 2010, coal accounted for 43% of global greenhouse gas emissions and this climate issue has perpetuated ever since. As it simultaneously uses less energy and cuts down on using natural resources, recycling metals is an environmental activity — and an easy way to take corporate responsibility.

2. To best use raw materials. Metals are amongst the few raw materials easily recycled without damaging their original properties. This means there isn’t any real reason to create new metal — apart from to meet increased demand. The recycling process can be repeated as many times as needed, even with valuable metals such as aluminium.

The list of recyclable metals is extensive, with only radioactive metals (uranium, plutonium) and toxic metals such as lead and mercury prohibited. There aren’t many disadvantages to recycling metals, but a total waste management company can help you deal with any issues. Scrap metal recycling facilities will always accept a wide range of metals like steel, as operators know the value of metal won’t decrease.

3. To offset your business’s carbon emissions. There’s an increasing emphasis on companies recycling all raw materials to achieve ambitious “zero to landfill” targets. Recycling metals is an environmental alternative to other forms of disposal, as it cuts down emissions and reduces air pollution. By recycling metals, you’re contributing to your business’s carbon goals. Above all, the recycling process will help eliminate pollution from the atmosphere and encourage others to make the most of metal’s versatile usage.

A tonne of aluminium recycled saves nine tonnes of CO2 emissions from being released into the atmosphere. The Planet Mark environmental foundation confirms that every tonne of aluminium recycled conserves five tonnes of bauxite — the raw material from which aluminium is made.

4. To save money by reducing production costs. Recycling metals offers financial incentives and there’s no shame in benefiting from these. Most companies recycle on the basis that it’s cheaper to do so, allowing you to drive down production costs (and convert this spend into collection costs). It’s much more affordable to use existing waste metal than to create it from scratch.

5. To meet recycling industry standards. As people grow more concerned about the environment, the recycling industry is putting additional pressure on businesses to recycle. Companies are expected to recycle materials where possible, with metal recycling being a huge part of this. Needless to say, if you have scrap metal lying around on-site, you should take action. You’re also benefiting the economy by recycling metals as the recycling industry provides employment in waste facilities.

Metal items can be hard to recycle, but the benefits far outweigh any difficulties. The key to recovering all the value from metal is effective segregation and quality control before it finds its way to a metal recycler.

Here Are Some Of The Top Products In The U.S. Metal Recycling Market

1. Ferrous Scrap Metal- Recycled iron and steel from automobiles, appliances, construction debris, etc.

2. Non-Ferrous Scrap Metal- Includes aluminum, copper, brass, stainless steel—high-value recyclables.

3. Rebar (Reinforcing Bar)- Steel bars used in construction, made from recycled scrap.

4. Steel Beams & Structural Steel- Produced by mills using recycled metal for construction and infrastructure.

5. Sheet Steel & Coil- Flat-rolled steel products used in automotive, appliances, and manufacturing.

6. Shredded Scrap (Shredder Feed)- Processed scrap used as feedstock for electric arc furnaces.

7. Copper Wire & Tubing- Recycled and resold for use in electrical and plumbing applications.

8. Aluminum Products- Recycled aluminum cans, extrusions, and automotive parts.

9. Steel Billets & Rods- Semi-finished products used for further steel manufacturing.

10. Stainless Steel Scrap- High-value material used in high-grade steel production.

What Are the Major Trends In The U.S. Metal Recycling Market?

- Shifting toward “green” production processes, such as adoption of electric arc furnaces that rely more on recycled feedstocks rather than virgin metal sources.

- Growing use of digital platforms for scrap trading, improving transparency, efficiency and access to buyers and sellers.

- Increasing regulatory and policy encouragement for recycled content, driven by sustainability goals and environmental standards.

- Rising investor interest in recycling operations and infrastructure as sustainability becomes a core component of corporate strategies.

- Stronger focus on recovering non-ferrous and specialty metals because they carry higher value and are in demand for high tech, electronics, and clean energy application.

How Does AI Influence the Growth Of The U.S. Metal Recycling Market In 2025?

In 2025, AI is reshaping the U.S. metal recycling contamination, increasing recovery yields, improving quality of recycled output. AI driven computer vision systems are being used to distinguish different metal type and grades in mixed streams (e.g. aluminium, copper) with high accuracy (as demonstrated by TOMRA’s deep learning solution for aluminium sorting). Robotic arms guided by machine learning are automating pick and place operations in scrap yards, reducing reliance on manual labour and enabling faster throughput. AI also powers predictive analytics and process optimization tools anticipating maintenance needs, optimizing conveyor speeds and workflows, and reducing operational downtime.

U.S. Metal Recycling Market Dynamics

Growth Factors

What’s Powering Quality And Purity In Recycled Metals?

AI driven sorting systems are being integrated into metal recycling plants to distinguish subtle visual features (such as surface texture or shape) and thus separate mixed or alloyed metals more accurately, which raises the purity of output and reduces waste.

Why Is Nonferrous Scrap Flowing Into The U.S.?

Trade tensions and high global prices for nonferrous metals are rerouting scrap exports onwards the U.S. making imported nonferrous metal feedstock more available for domestic recycling operations.

Market Opportunity

What If E-Waste Becomes The New Goldmine?

The rise of electronics usage and the sheer volume of discarded devices open a lucrative avenue for metal recyclers to tap into urban mining extracting critical and rare metal from printed circuit boards, batteries, and other consumer electronics instead of relying solely on bulk scrap.

Could Domestic Refining Of Critical Metals Reshape The Supply Chain?

With the U.S. seeking self-sufficiency strategic metals, opportunities are growing for recycling firms that can integrate advanced refining technologies to recover cobalt, nickel, lithium and rare from industrial waste and battery feedstock, reducing dependence on imports.

Limitations In The U.S. Metal Recycling Market

- Global market changes can cause metal prices to vary, making recycling operations less predictable and affecting profitability.

- Varying state regulations and proposed changes can create compliance uncertainty and operational hurdles for recyclers.

What Drives Dominance in The U.S. Metal Recycling Market?

In the U.S. metal recycling market, the automotive industry okays a pivotal role, serving as a significant source of scrap metal. End of life vehicles (ELVs) contribute substantially to the supply of ferrous and non-ferrous metals, including steel, aluminium, and copper. This consistent influx of materials supports established recycling infrastructure, such as shredding and dismantling facilities, assuring a steady flow of recyclable metals. The automotive sector’s integration into the recycling loop not only bolsters material recovery rates but also aligns with sustainability goals by reducing the need for virgin resources. As the demand for recycled metals continues to rise, the automotive industry’s contribution remains integral to the market’s growth and stability.

U.S. Metal Recycling Market Segmentation Insights

Metal Type Insights

Why Are Ferrous Metals Segment Dominating the U.S. Metal Recycling Market?

The ferrous metals segment dominated the U.S. metal recycling market in 2024. Ferrous metals, primarily steel and iron, are highly used in construction, automotive, and heavy machinery, making them abundant in scrap streams. Their widespread availability and high recyclability have established a stable demand for ferrous recycling, supporting extensive collection, sorting, and processing infrastructure. Recycling these metals not only reduces energy consumption compared to primary production but also contributes significantly to environmental sustainability initiatives across the U.S. As industries continue to rely on steel and iron, ferrous metals maintain a prominent role in shaping the market’s current and future dynamics.

The non-ferrous metals segment is projected to grow at the fastest rate during the forecast period. Non-ferrous metals such as aluminium, copper, and zinc are increasingly valuable due to their demand in electronics, automotive lightweight, and renewable energy sectors. These metals are more expensive and technologically critical, which drives efforts to improve collection and advanced recycling methods for better purity and efficiency. As manufacturers seek sustainable alternatives and reduced dependence on virgin metals, non-ferrous recycling presents an opportunity for higher margins and technological innovation. The market’s focus on energy efficiency and circular economy principles further accelerates the adoption and growth of non-ferrous metal recycling.

Recycling Method Insights

Why Is Mechanical Processing Segment Doming In U.S. Metal Recycling Market?

The mechanical processing segment dominated in 204. Mechanical methods, including shredding, sorting, and baling, are widely used due to their cost efficiency and scalability across various metal types. This approach supports large volumes of scrap material, particularly ferrous metals, assuring steady output and operational efficiency. The simplicity and reliability of mechanical processing have allowed recyclers to maintain consistent recovery rates while integrating new sorting technologies.

The hydrometallurgical segment is expected to experience the highest growth rate between 2025 and 2034. Hydrometallurgy involves chemical processes to extract metals from complex or low-grade materials, which is increasingly important for non-ferrous and critical metals. This method allows recyclers to recover metals with higher purity that mechanical processes cannot achieve, opening new opportunities in electronics, batteries, and specialty metal recycling. Growing environmental regulation and the push for sustainable metal recovery further drive the adoption of hydrometallurgical techniques.

Source Insights

Why Are Post-Industrial Scraps Segment Dominating U.S. Metal Recycling Market?

The post-industrial scrap segment dominated in 2024. Post-industrial scrap, generated from manufacturing processes and production waste, is highly reliable and consistent, making it a preferred source for recyclers. Its predicted composition allows efficient sorting and processing, especially for ferrous and non-ferrous metals. Industries such as automotive and construction generate continues streams of post-industrial scrap, ensuring that recyclers have access to high quality feedstock. This steady supply supports operational stability and contributes to sustainability by reducing the need for virgin metal extraction.

The post-consumer scrap segment is projected to expand rapidly in the coming years. Post-consumer scrap, collected from end-of-life products such as electronics, appliances, and packaging, is increasingly targeted due to regulatory incentives and corporate sustainability goals. Advancements in collection systems and sorting technologies make it more feasible to diverse consumer scrap streams efficiently. The growing focus on circular economy practices ensures that post-consumer scrap becomes a critical resource for reducing waste and supporting metal demand.

End User Industry Insights

Why Are Automotive Segment Dominating In U.S. Metal Recycling Market?

The automotive segment dominated in 2024. The automotive industry generates large volumes of end-of-life vehicles and manufacturing scrap, providing a consistent and high quality source of both ferrous and non-ferrous metals. Recyclers rely on automotive scrap to maintain operational efficiency, as it is easier to sort and process compared to mixed consumer scrap. The industry’s, integration into the recycling ecosystem ensures that recovered metals are redirected into the new vehicle production and other applications. The automotive sector’s contributions make it a cornerstone of the market.

The electronics segment is anticipated to grow with the highest CAGR in the studied years. Electronics generate complex and valuable scrap, including copper, aluminium, and rare earth metals, which are in high demand for new devices. Growth in consumer electronics, renewable energy systems, and electric vehicles increases the volume of recoverable metals from electronic waste.

Recycling Facility Type Insights

Why Are Integrated Mills Segment Dominating in U.S. Metal Recycling Market?

The integrated mills segment dominated in 2024. Integrated mills, which combine multiple recycling operations including shredding, sorting, and remelting, offer higher efficiency and centralized control over metal recovery. These facilities handle large volumes of scrap, particularly from automotive and industrial sources, assuring steady production and consistent quality. Their established distribution networks and operational expertise make them a preferred choice for recyclers seeking reliability and scale.

The specialized plants segment is predicted to witness growth over the period 2025 to 2034. Specialized plants focus on high value hard to recycle metals such as lithium, cobalt, and rare earth elements from batteries and electronics. Advanced technologies and targeted processes allow these facilities to recover metals that traditional mills cannot energy and electronics, specialized plants are becoming essential for supplying recycled metals.

More Insights in Towards Chemical and Materials:

- Copper Foil Market : The global copper foil market volume is calculated at 387.50 kilo tons in 2024, grew to USD 415.07 kilo tons in 2025 and is predicted to hit around 770.50 kilo tons by 2034, expanding at healthy CAGR of 7.11% between 2025 and 2034.

- Mechanical & Chemical Recycling of Polyethylene Market : The global mechanical & chemical recycling of polyethylene market was valued at approximately USD 17.35 billion in 2024 and is projected to grow at a CAGR of 10.29% from 2025 to 2034, reaching a value of USD 46.20 billion by 2034.

- Microplastic Recycling Market ; The global microplastic recycling market size was reached at USD 325.19 million in 2024 and is expected to be worth around USD 817.00 million by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period 2025 to 2034.

- Mechanical Recycling of Plastics Market : The global Mechanical Recycling Of Plastics Market is expected to reach a volume of approximately 54.87 million tons in 2025, with a forecasted increase to 120.26 million tons by 2034, growing at a CAGR of 9.11% from 2025 to 2034.

- Aluminum Oxide Market : The global aluminum oxide market volume was reached at 160.12 million tons in 2024 and is expected to be worth around 215.45 million tons by 2034, growing at a compound annual growth rate (CAGR) of 3.01% over the forecast period from 2025 to 2034

- Aluminum Trihydrate (ATH) Market ; The global aluminum trihydrate (ATH) market volume was reached at 2850.21 kilo tons in 2024 and is expected to be worth around 4653.45 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034.

- Aluminum Foil Market : The global aluminum foil market size was reached at USD 29.33 billion in 2024 and is expected to be worth around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

- Aluminum Composite Materials Market : The global aluminum composite materials market size is calculated at USD 3.84 billion in 2024, grew to USD 4.14 billion in 2025, and is projected to reach around USD 8.18 billion by 2034. The market is expanding at a CAGR of 7.85% between 2025 and 2034.

- Flat Steel Market : The global flat steel market size accounted for USD 687.55 billion in 2024 and is predicted to increase from USD 724.33 billion in 2025 to approximately USD 1,157.84 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034.

- Green Steel Market ; The global green steel-market size was valued at USD 718.55 billion in 2024, grew to USD 763.10 billion in 2025, and is expected to hit around USD 1,311.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.20% over the forecast period from 2025 to 2034.

-

Hot Rolled Coil (HRC) Steel Market ; The global hot rolled coil (HRC) steel market size accounted for USD 355.42 billion in 2024, grew to USD 375.86 billion in 2025, and is expected to be worth around USD 621.65 billion by 2034, poised to grow at a CAGR of 5.75% between 2025 and 2034.

U.S. Metal Recycling Market Top Key Companies:

- Schnitzer Steel Industries, Inc.

- Nucor Corporation

- Commercial Metals Company

- Alter Trading Corporation

- Sims Metal Management

- Radius Recycling

- Metal Management Inc.

- OmniSource Corporation

- Tube City IMS

- Philip Metals Inc.

- Hugo Neu Corporation

- Ferrous Processing & Trading Corporation

- Sadoff Iron & Metal Company

- Yaffe Companies, Inc.

- Louis Padnos Iron & Metal Company

- Adams Steel, Inc.

- Pacific Coast Recycling, Inc.

- Azcon Corporation

- Tennessee Valley Recycling

- Ellis Metals, Inc.

Recent Developments

-

In March 2025, in s significant industry consolidation, Toyota Tsusho America has acquired Radius Recycling for $1.34 billion, marking a 115% premium over Radius’s stock price. This acquisition is poised to enhance Toyota Tsusho’s capabilities in the U.S. recycling sector, particularly in automotive applications, by integrating Radius’s established infrastructure and expertise.

U.S. Metal Recycling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global U.S. Metal Recycling Market

By Metal Type

- Ferrous Metals

- Steel

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Iron

- Cast Iron

- Wrought Iron

- Non-Ferrous Metals

- Aluminum

- Copper

- Lead

- Zinc

- Nickel

- Precious Metals (Gold, Silver, Platinum Group Metals)

By Recycling Method

- Mechanical Processing (Shredding, Shearing, Baling, Granulation)

- Pyrometallurgical Processing (Smelting, Refining)

- Hydrometallurgical Processing (Leaching, Electrowinning)

- Biotechnological Processing (Bioleaching, Bioremediation)

By Source

- Post-Consumer Scrap (End-of-Life Vehicles, Household Appliances, Electronics)

- Post-Industrial Scrap (Manufacturing Waste, Construction & Demolition Debris)

- Obsolete Scrap (Discarded Industrial Equipment, Retired Infrastructure Materials)

By End-User Industry

- Automotive

- Construction

- Electronics

- Aerospace

- Packaging

- Energy

- Consumer Goods

By Recycling Facility Type

- Integrated Mills (Mini Mills, Electric Arc Furnace Mills)

- Recycling Centers (Material Recovery Facilities, Scrap Yards)

- Specialized Processing Plants (Aluminum Refineries, Copper Smelters)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5873

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.